Your twenties are a time of exploration. Fresh out of college, you finally have the freedom to explore the life you want to pursue and take the necessary investment to make. You get your first job, your first paycheck, and your first real purchase. It feels good to have that freedom of being able to buy whatever you want, either for yourself or your loved ones.

With this freedom however comes responsibility. You should be able to learn how to manage your finances wisely. There’s nothing wrong with buying and splurging, but you should have a goal. A big part of being independent is financial independence. As early as your twenties, having a financial goal is a good way to prepare for the future. Now is the perfect time to start investing because you are young, healthy, and career-driven.

When you hit your 30s, priorities start to change because of your circumstances. You may be married already, have kids, or have a different career goal. Avoid the common mistake of not saving up before you reach this milestone. As you get older, you will realize the importance of investing early and having financial security at an early age.

The good news is, there are many ways to make a wise investment before you reach the age of 30. You don’t have to deprive yourself of your wants, but being mindful of your expenses is a great practice. In the list below, we gathered the top ten investments which you can start before you reach the age 30. Having these goals in mind will keep you in track towards a better financial position.

Here are ten wise investments you should make before turning 30.

Settle all your debts before Clear Investments

Focus on paying your debts including student loans, car loan, credit cards, etc. These loans come with a high interest, so you don’t want to miss your due date. Make sure to include your debts in your monthly budget. Getting a loan is not a bad idea, it is almost inevitable when you are just starting out. While this is normal, strive for a debt-free life if you can.

Tip: There are apps available that let you track your monthly budget. Try this method to ensure your payments are on time.

Grow from Little Investments

Aside from your day job, isn’t it great to have another source of income? You can start investing to generate a passive income. There are a lot of small, budget-friendly investments; you don’t have to dive immediately to buying big investments. With a small capital, check the market and discern what you really want to invest in. You can also consult experts for investment tips and financial advice. The key here is to invest wisely. Be sure to prepare for it before jumping to that investment.

Initiate a Small Business Investment

Perhaps you have a hobby or an interest that you’ve always wanted to pursue ever since? A small café? A laundry shop or a catering service? Whatever it is that you’re passionate about, it is a good foundation to start a small business. But this doesn’t stop there. You have to learn the market, do intensive research, and assess the competition. If you’re skillful and lucky, your small capital can go a long way.

Tip: Read about starting a business to get some inspiration from successful entrepreneurs who started out small.

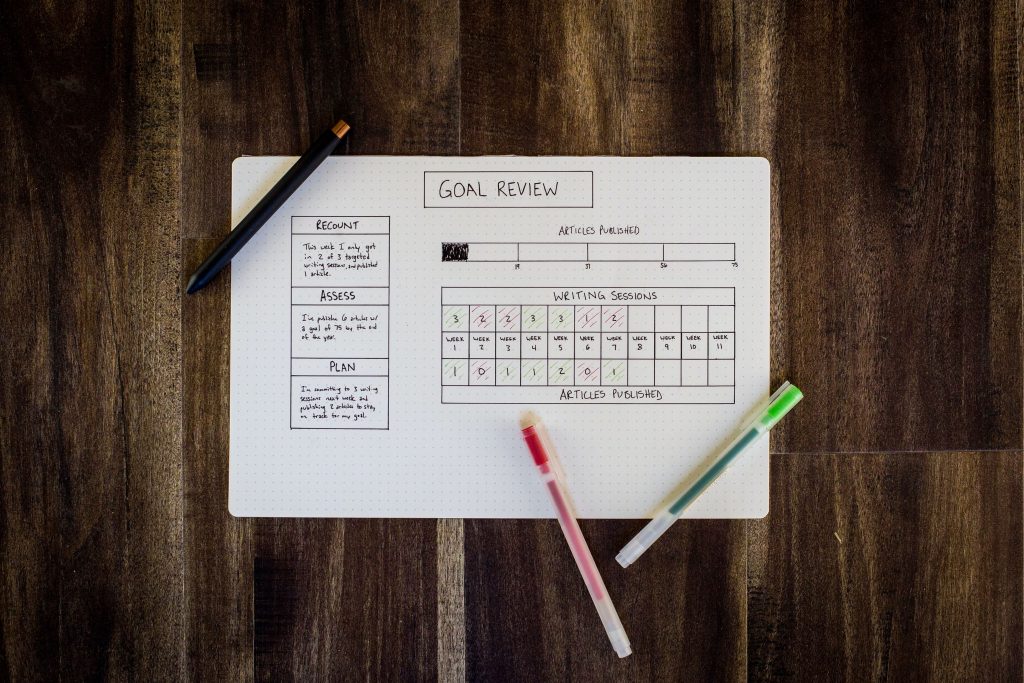

Set long-term Goals

Let’s admit it, you are not getting any younger. In your thirties, you start planning your future for the long-term. At this stage, you consider many aspects of life, especially when you have a spouse or a child already. Setting long-terms goals is important because it will help give you a direction in terms of your financial behavior. Prioritizing is key when it comes to setting goals. Consider investing and not just saving. It has a higher chance of growth than just letting your money sit on the bank. There are plenty of ways to invest, you just have to be very wise in picking the right investment that will work for you. You can also consult a financial adviser to guide you.

Tip: Writing your goals will help you visualize and as well as motivate you to achieve them. Try to put a timeline but being flexible is also part of it.

Invest an Insurance Policy

Insurance is often neglected by those in their twenties for many reasons. They don’t see the potential of preparing early in case something unexpected happens. Having a good insurance policy will be a huge help in the future and has better benefits when you start out young. You will get less premium because of your healthy physical state and better coverage.

Tip: Be sure to come to a trusted adviser in choosing an insurance policy.

Buy a Health Insurance Policy

Sure, you are young and healthy. You are at the prime of your health in your twenties but one big health emergency can wipe out all your savings in one go. Sad but true. This reality has affected many families due to unforeseen events.

Medical cost is one of the most expensive thing nowadays. Hospitalization alone is a big cost, not to mention the medicines you have to purchase. If your current employer provides medical insurance, then good for you. Better if your family members or dependents are covered as well. But sometimes, that is not enough. The best time to get a health insurance policy is during your twenties because there is less premium and better coverage policy. It will also give you a peace of mind that you are medically secured in any case.

Create an Emergency Fund

Like what the word suggests, emergencies are unexpected. You never know when it will happen and so being financially prepared is very important at times like these. Aside from your long-term goals and investments, having an emergency fund can save you from big trouble. Whether it is an emergency house repair, you suddenly lose a job, a broken appliance, or you have to pay something you did not expect, having something to pull out of your pocket will come in handy.

You don’t need to stress yourself looking for a contingency fund or borrow money from others. Emergency funds are ideally three to six months’ worth of your salary. This amount is good enough to supply any short-term emergency. However, if this is not workable with your budget, set aside a reasonable amount every month to add to your pool of money to cover an urgent and unexpected situation. Make sure that you do not touch this fund unless really needed. It is also not recommended to keep your emergency fund in the same personal bank account.

Invest for your Retirement

You might be wondering, I am just in my twenties and turning thirty soon. Why should I plan for my retirement as early as now when in fact I am just starting to build my own life? While it is true that your retirement years are way ahead of you, there is nothing wrong with starting as early as possible. You may postpone this for a few more years or so, but why not begin now when you are capable and earning enough? Setting aside for your retirement will spell a huge difference in the future. You don’t have to save big immediately for your retirement, even a small amount or ideally 5% of your salary is good enough.

As you grow older, you can increase this target to 20% or higher depending on your capacity. Preparing early for your retirement also gives you the freedom to retire early and start enjoying life.

Invest your own Car

Having your own car gives you more independence. You can travel to anywhere you want to go anytime. Owning your first car in your twenties has a lot of perks. You can use it to drive yourself to work, have a roadtrip with your friends, or simply run errands. Commuting via public transport may be a lot cheaper but a car gives you more convenience.

Now that you are earning your own money, it’s time to improve your lifestyle by driving your own wheels. There are many loans available depending on your paying capacity. It doesn’t have to be a brand new car but it is more advisable so as to save yourself from the hassle of repairs.

Buy your Own Property Investment

Moving out of your parents’ house is one of the bravest things you can do before you turn 30. Although not a popular practice here in the Philippines, moving out and living on your own will give you a good sense of independence now that you are building a life of your own. In buying your first real estate investment, you should consider a lot of things including the practicality, the location, and even the security. Your first pad can be an affordable condo unit near your work. You can also opt to have it rented for an extra source of income. There are a lot of options nowadays for an affordable housing. Depending on your goal, starting early to invest in your own house will give you more time to pay off your home loan. The best time to own your first pad is when you are financially stable and ready to live independently.

The road to financial independence is best to start in your twenties. Although these financial goals are not cast in stone, starting early would be beneficial not just for you but also for your family. Try reaching these milestones according to your own pace and you are set for a financially- secured future.

Property investment is one good investment to start early. Looking for a good location is the key for a real estate investment. In the Visayas, Bacolod City is a leading investment hub because of its economic growth and development over the years. It is one of the top livable cities in the country and named as the Top Model City of the Philippines in 2017 and 2019. Bacolod’s bright future makes it an ideal place for your next investment. Real Estate is on the rise with the presence of many industry players offering horizontal, vertical, and commercial developments.

Why invest in Camella Manors Olvera?

Looking for an affordable condo in Bacolod? Explore life in Bacolod with Camella Manors.

Camella Manors Olvera is the first project of Camella Manors in the Visayas to become part of Vista Land’s communicity. Camella Manors is Vista Land’s newest mid-rise condominium brand located in the regions and nearby provinces of Metro Manila. It promotes an all-in lifestyle needs and resort-themed amenities that will cater to young professionals, starting families, investors, and Overseas Filipino Workers (OFWs). A resort-themed condo, The Olvera pioneers a hassle-free urban living in the midst of a booming economy. The condo is ready for occupancy in its first two buildings this 2021. Camella Manors Olvera is a 1.1 hectare mid-rise condominium with a total of 4 buildings.

Located along Cordova-Buri Road, Mandalagan, this affordable condo in Bacolod will give investors the best deal for its money with its world-class amenities which include a swimming pool, kiddie pool, fitness gym, club house, playground, and commercial strips. There is also 24/7 security to ensure the safety of everybody. It is also a pet- friendly community.

Camella Manors Olvera offers the perfect synergy of comfort and luxury. It is strategically located near malls, hospitals, schools, tourist attractions, and business districts. It is located 15 minutes away from the Bacolod- Silay International Airport.

Unit owners in Building 1 and 2 can finally enjoy their new home by the second quarter of the year. Both buildings, Ibiza and Majorca, are 7-storey high. Each unit measures 30.36 sq. m. The pre-selling of condo units of the third building, Capri, will be opening soon.

To know more about Camella Manors Olvera, click here. Reservations can also be done conveniently and hassle-free through our easy-to-use online payment facilities.